kane county illinois property tax due dates 2021

Every year on the last Monday of October the Kane County Treasurer holds its annual tax sale to auction off all unpaid taxes for the current year. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Miles Of Improvements Await Kane County Bicyclists This Spring

Elsewhere a county board may set a due date as late as June 1 The second installment is.

. Yearly median tax in Kane County. DUE DATES FOR REAL ESTATE TAX BILLS ANNOUNCED KANE COUNTY TREASURER Michael J. Tax amount varies by county.

Any questions on Tax Sale procedures and. A property must be the principal residence of the owner for the beginning of two consecutive years and the owner must be 65 or older by December 31 of the tax assessment year and meet. Tuesday March 1 2022.

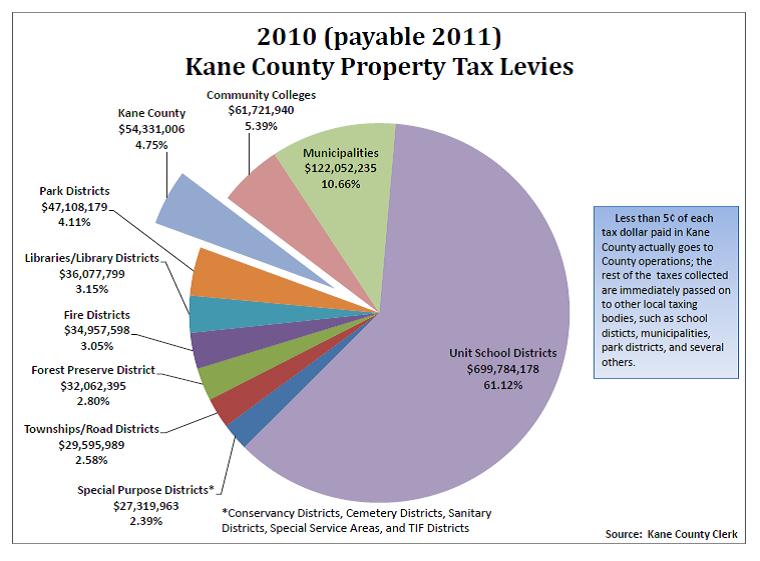

The County Clerk tax staff calculates the tax rate set within statutory limits by the local board for each taxing district t o each propertys valuation set by the Township Assessor. 209 of home value. Batavia Avenue Geneva IL.

Tax Year 2020 First Installment Due. Friday October 1 2021. Tax Year 2021 First Installment Due Date.

Property Tax Bills To Be Mailed April 29 1st Installment Due June 1 Kane County Connects. Welcome to the Kane County Treasurer E-Notify Service. This installment is mailed by January 31.

You may sign up with your email address to receive installment due date reminders and payment notifications for any Parcel Number s. Property taxes are paid at the Kane County Treasurers office located at 719 S. Kilbourne MBA announces that 2021 Kane County Real Estate tax bills that are payable in.

Accorded by state law the government of your city public schools and thousands of various special purpose units are given authority to evaluate real property market value fix tax rates. 042922 Property Tax bills are mailed. In Cook County the first installment is due by March 1.

How To Pay Your Property Tax Bill Online Kane County Connects. 173 of home value. The Tax Sale for all delinquent and unpaid taxes occurred on October 31 2022.

You may call them at 630-232-3565 or visit their website at. The median property tax in Kane County Illinois is 5112 per year for a home worth the median value of 245000. 050222 Drop Box.

The best way to search is to enter your Parcel Number or Last Name as it appears on your Tax Bill. The final day for payment of property taxes was Friday October 28 2022. Kane county illinois property tax due dates 2021 Tuesday March 15 2022 Edit State of Illinois and the third-most populous city in the United States following New York City.

Tax Year 2020 Second Installment Due Date. 051122 Subtax may be paid by prior year tax buyers if going to deed. 2021 Tax Year Calendar of Events in 2022.

Eminent Domain Condemnation Attorneys In Kane County

Estimated Effective Property Tax Rates 2009 2018 Selected Municipalities In Northeastern Illinois The Civic Federation

Elder Law Attorney Near Me Kane County Il 847 628 8311

Divorce Papers Kane County Il Free Call 847 628 8311

Retirees Need To Take Action For Latest Property Tax Rebate Npr Illinois

Kane County Home Values Down 29 Property Tax Up 4 Since Recession

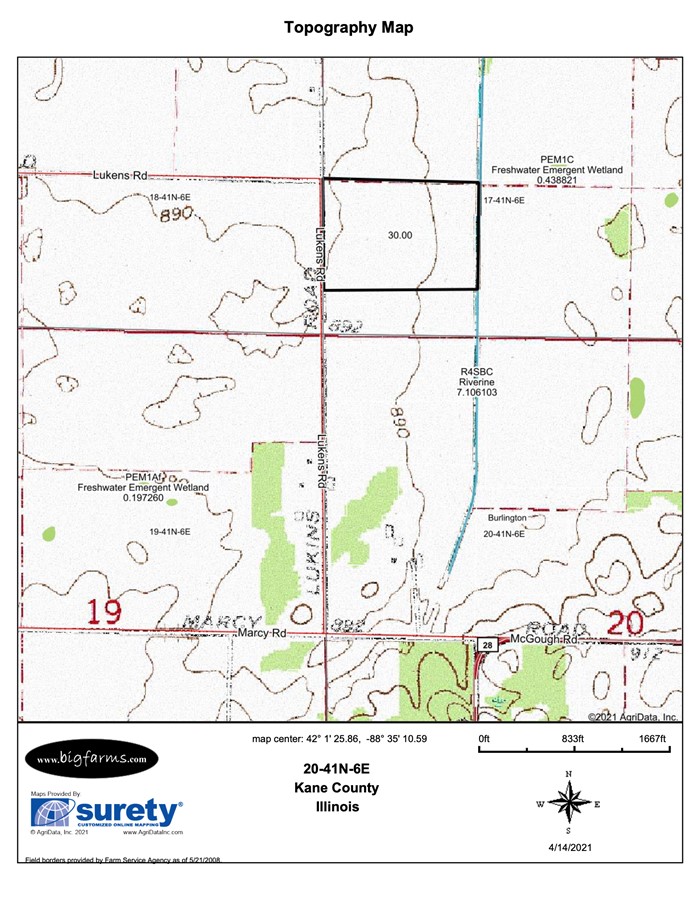

Property For Sale Sycamore Il Kane County 30 Acre Janes Farm Burlington Township

Kane County Property Tax Inquiry

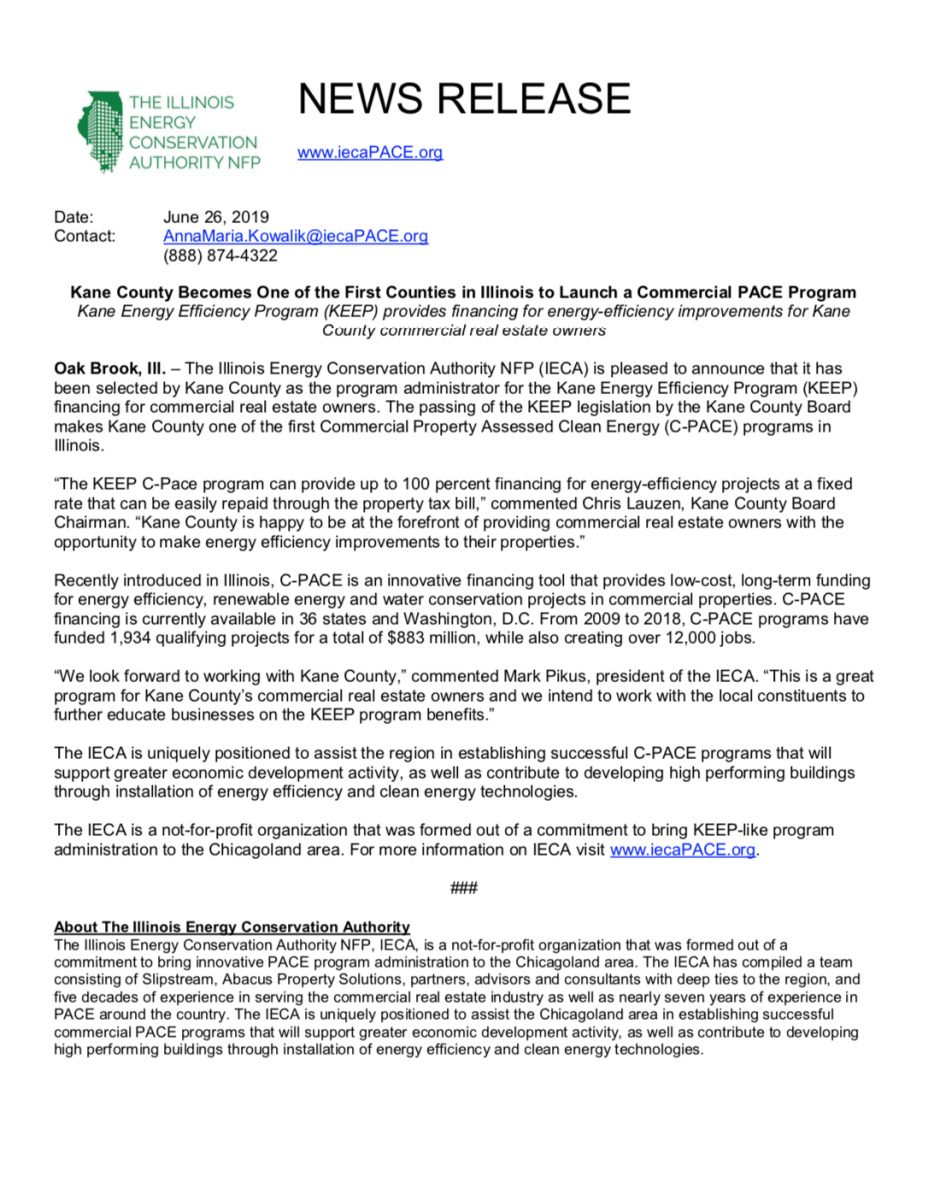

Kane County Energy Efficiency Program Keep The Illinois Energy Conservation Authority Nfp

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

Property Taxes City Of St Charles Il

Dupage Property Tax Due Dates Fausett Law Office

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation